Digital Engineering Services

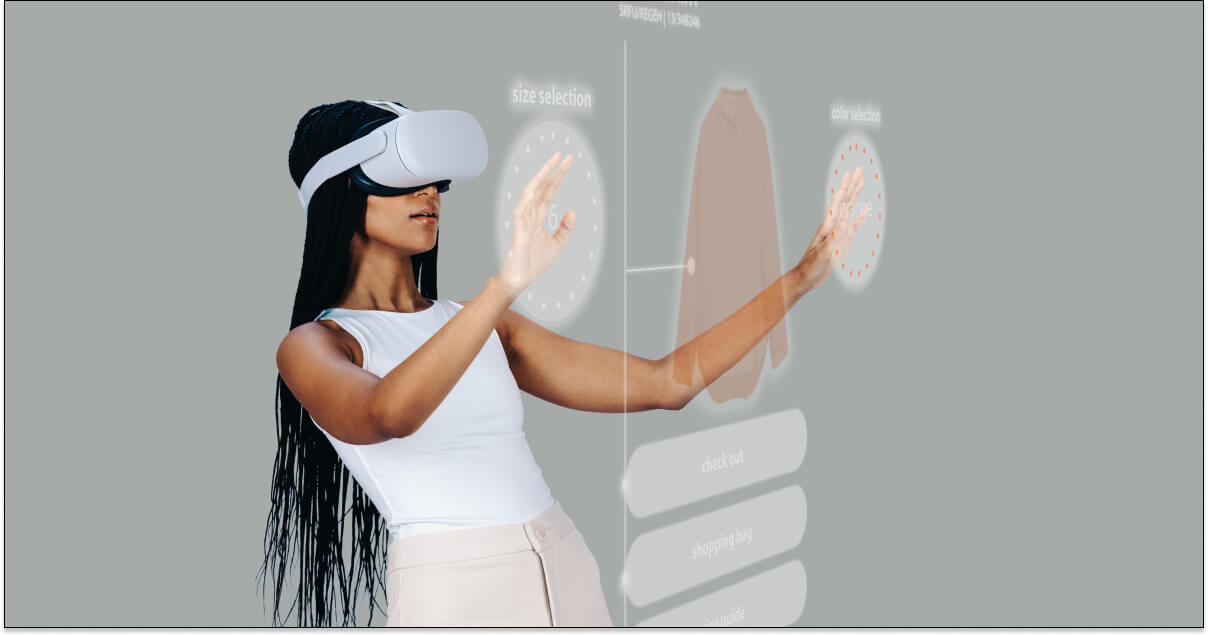

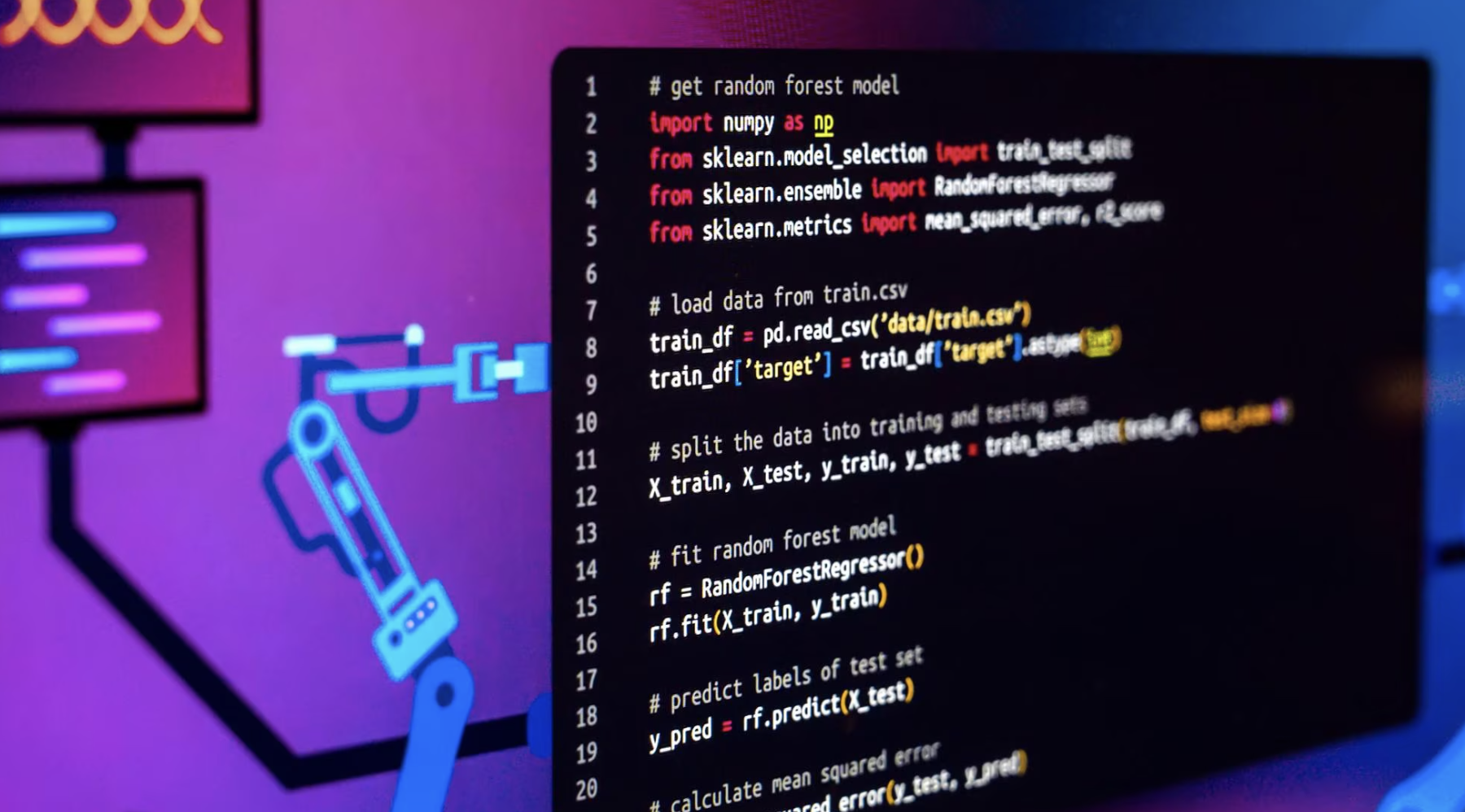

Harness the power of Generative AI

Amplify innovation, creativity, and efficiency through disciplined application of generative AI tools and methods.

NEW

Focus Industries

Explore Client

Success Stories

We create competitive advantage through accelerated technology innovation. We provide the tools, talent, and processes needed to accelerate your path to market leadership.

learn moreGlobal Delivery with Encora

Experience the power of Global

Digital Engineering with Encora.

Refine your global engineering location strategy with the speed of collaboration in Nearshore and the scale of expertise in India.

Accelerating Innovation

Cycles and Business Outcomes

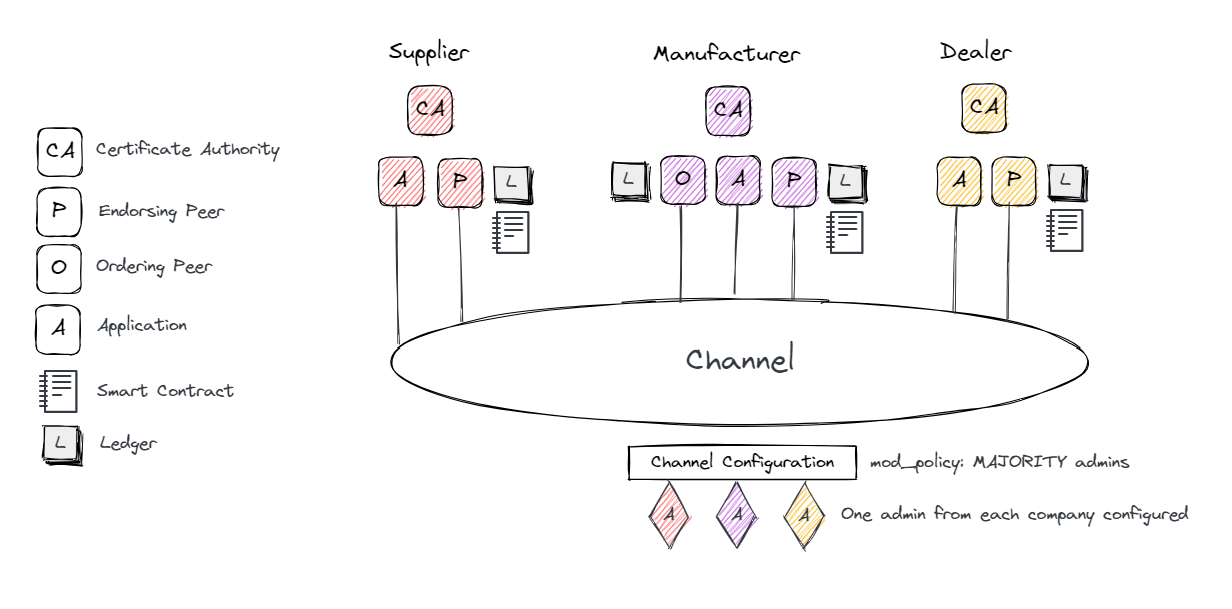

Through strategic partnerships, Encora helps clients tap into the potential of the world’s leading technologies to drive innovation and business impact.

SEE ALL partnersLatest News

Open positions by country