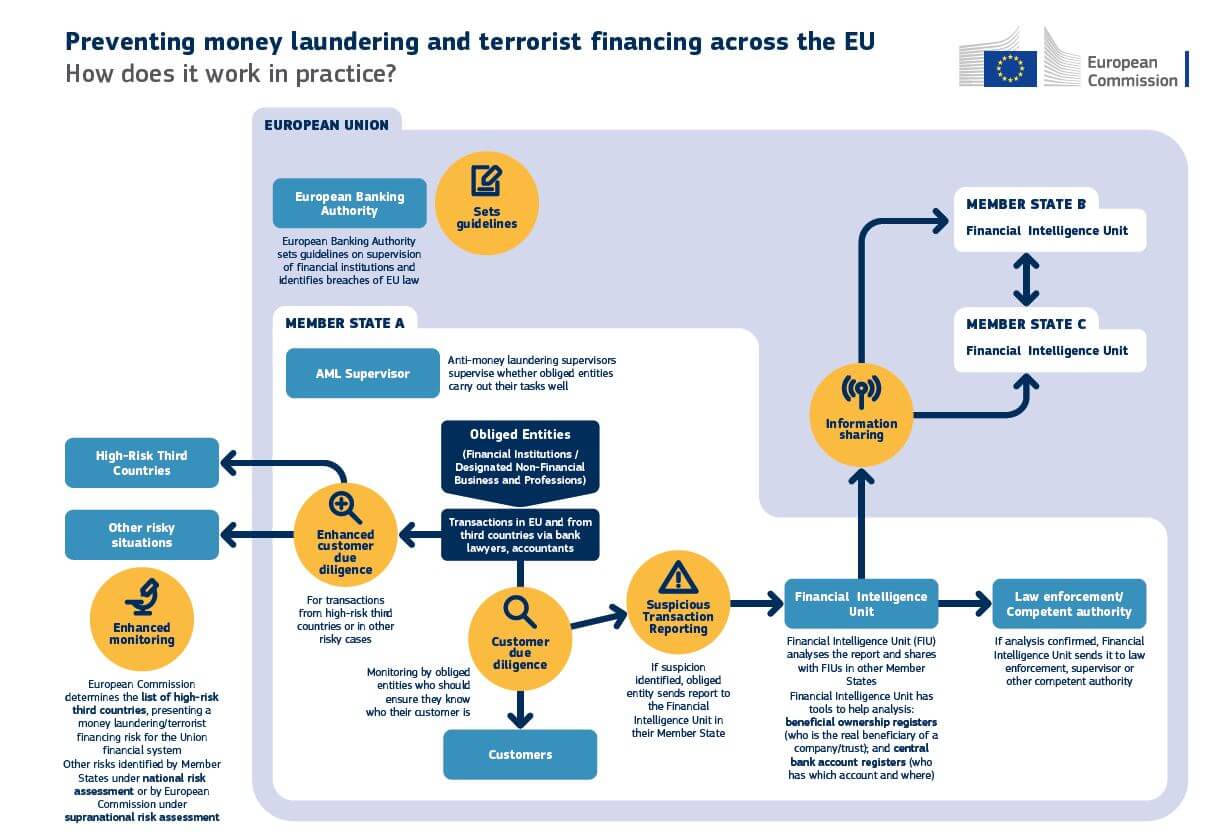

Risks of money laundering, the financing of terrorism, and the security of the citizens have always been a major concern for the European Union and remain of paramount importance during the COVID-19 crisis, as well.

Fighting money laundering and terrorist financing contributes to global security, the integrity of the financial system, and sustainable growth, and the laws to combat them are designed to prevent the financial market from being misused for these purposes.

Source: European Commission

The essentials of the AML5 directive in the context of software solutions

The 5th Anti-Money Laundering Directive or AML5 / 5AMLD is the EU directive to prevent money laundering and terrorist financing adopted and entered into force on 9 July 2018 being implemented into the national legislation of all member states by 10 January 2020.

This directive established a legal framework that seeks to balance the need for increased security with the protection of fundamental rights and economic freedoms. The main news in comparison to the previous directives was the requirement for exchange or cryptocurrency organisations to strengthen their mechanisms for online identity verification within the customer onboarding processes.

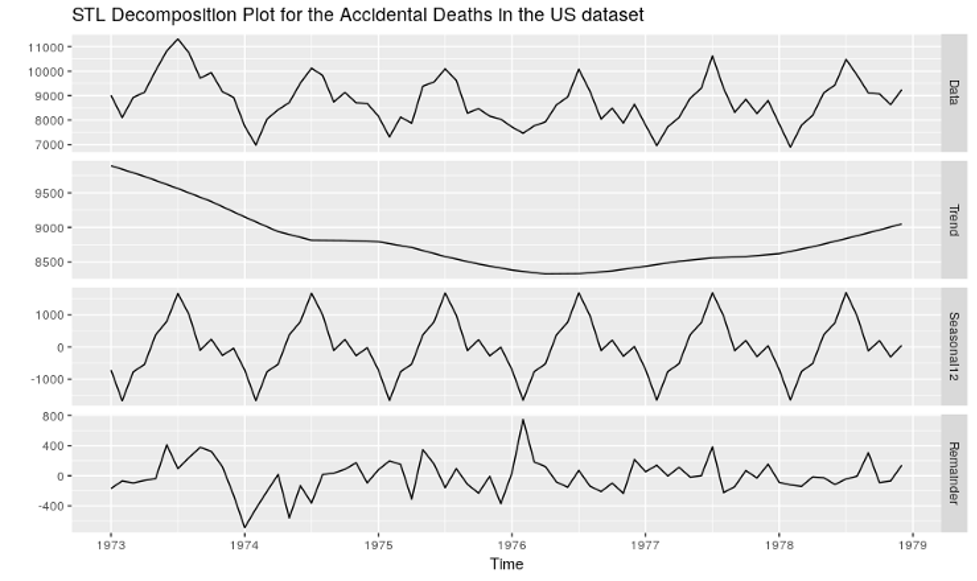

Source: globalbankingandfinance.com

With the latest update of the AML directive, the EU remained at the forefront of data protection and security regulations, focusing in this case on the need to control digital customer verification. Thereby AML5 regulation focused on the transformation of KYC processes to comply with the standards and procedures proposed by AML and eIDAS regulations and establish guidelines for verifying customers at a high-security standard. About the KYC verification procedure, we’ve discussed earlier in one of the previous articles that you can find here.

In the financial sector, the AML5 regulations have been applied to financial services covering payment methods, crediting, electronic currency, investment, as well as on activities specific to insurers, advisors, notaries, or lawyers, creating a unique digital space for client identification. As financial institutions build long-lasting brands, they aim to achieve both financial success and excellent service. To keep pace with the need to prevent money laundering, banks also had to innovate by developing robust anti-money laundering policies and practices.

The AML5 covers definitions and regulations for client identification. Adopting these rules brought great advantages to organisations, accessing millions of new potential customers in a much easier, regulated, and automated way.

A beneficial change was the obligation of the specific and complete identification of the real possessor of passbooks, bank accounts, or e-wallets that, until then, could have been anonymous, affecting the banking and financial sector, both in traditional and online banking.

Video-based customer identification process with artificial intelligence and biometric authentication with facial recognition technology has been relied upon to achieve this level of legal and technical security equivalent to face-to-face identification established by 5AMLD.

Also, providers such as eID, whom we partner with actively, had the first AML5 solutions that allow the identification of customers by video in less than 30 seconds and meet the high level of security required in bank account opening processes.

New AML regulations in 2021

The anti-money laundering directive landscape continues to evolve, new regulations are coming down the road and innovation is being embraced like never before to fight financial crime. The European Union is creating an action plan for a comprehensive Union policy on preventing money laundering and terrorist financing so the EU’s Sixth Anti-Money Laundering Directive (6AMLD) has come into effect and the members have until June 3, 2021, to transpose the new directive into national law.

The objective of these changes will impact how financial institutions worldwide meet their AML compliance obligations so organisations have to ensure that their AML program is meeting its new obligations to avoid being in for some uncomfortable conversations with law enforcement.

By investing in technology for AML compliance, financial institutions create competitive advantages and improve cooperation and exchange of information between anti-money laundering supervisors and the European Central Bank.

Among the benefits provided:

- Improved efficiency and transparency in the ownership of institutions

- Superior customer experience

- Extensibility

- Reduced reputational risk

- Readiness to adapt to a new directive

How can Encora help you?

Understanding where you are in your digital transformation process is the starting point of the journey. From there, we can help you deliver the best user experience in the era of digital transformation in banking and finance.

We can build tailored solutions for customer onboarding that balance ease of use with the highest levels of security and compliance. Our omnichannel software solutions help you in the implementation of trust services – video-based customer identification process, biometric authentication with facial recognition technology, electronic signature – that are fully compliant with AML regulation and data protection, to reduce costs while improving the user experience.

Resources:

- https://www.consilium.europa.eu/en/policies/fight-against-terrorism/fight-against-terrorist-financing/

- https://ec.europa.eu/info/sites/info/files/diagram_aml_2018.07_ok.pdf