Delivering a tailored user experience in the times of the pandemic

If there was already a fundamental shift underway in the workforce as new technologies on workplace culture start to change the way people work, the COVID-19 pandemic is accelerating these changes at a dramatic pace. As most businesses suddenly move to remote working, it’s easy to ignore business culture while crisis management takes hold.

This is a time when technology brings the most value.

How can insurers and brokers leverage a strong business strategy for remote workers during the coronavirus crisis?

A large part of the insurance business is still transacted using manual processes that are costly and can be prone to error. Quotes are being calculated manually and communicated via e-mail or even fax.

On the other hand, policies are being bound manually and any endorsements to policies require manual intervention which adds to the costs. If until recently there was only the inevitable pressure to become driven by digital transformation, now with the current pandemic that we are facing, the market is in imminent need of a more straightforward process.

Innovation in insurance has been a long due process, particularly when it comes to optimizing the user experience. Organisations are pressured to break away from the way it’s always been done to identify and put in practice new ways of how can they do business better.

Enabling insurance to become more digital

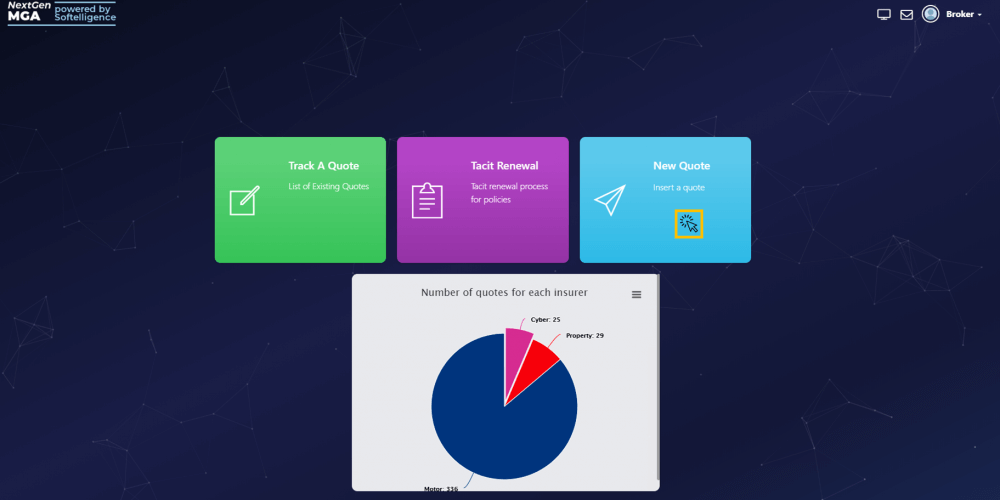

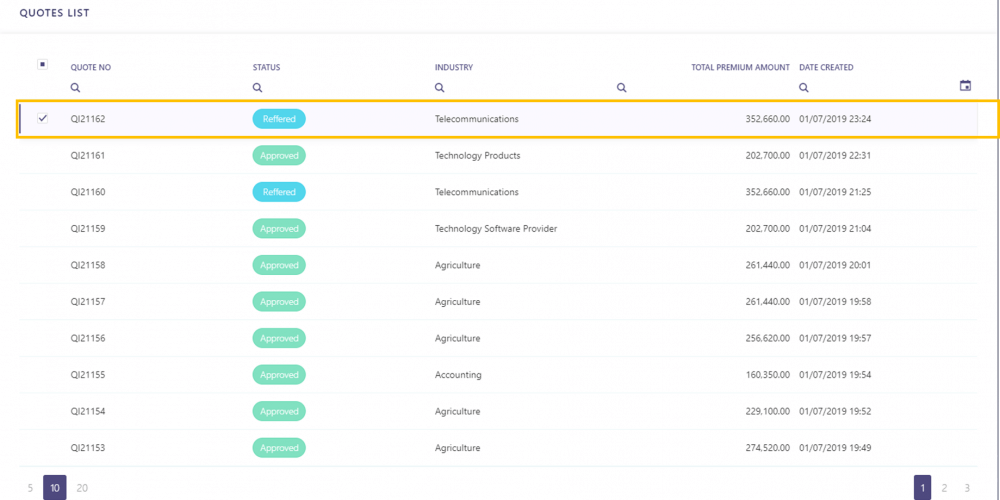

At Encora for example, through our NextGen Broker Portal concept, we have designed a 100% digital Quote and Bind journey to boost operational efficiency while removing many of the risks associated with the delegated business.

It’s a Quote and Bind process where the output is a quote for a Cyber or Property coverage from three different products with an additional step for upselling. By the end of the process, the broker can issue a combined policy.

If the limit of liability is exceeding a defined value, to issue a binding quote, an underwriter review and approval is needed. The underwriter is then able to quote for the business, ask for special terms or decline the business, all within the system.

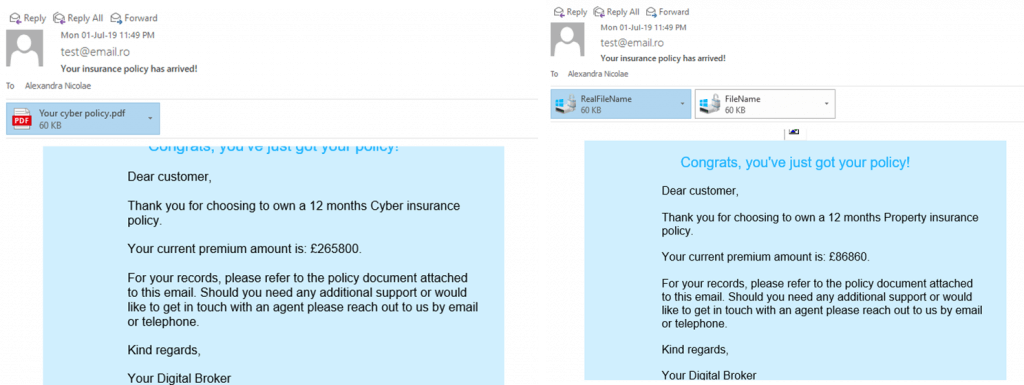

Furthermore, these solutions will automatically generate all the paperwork, including policy documents. An email notification would be sent to the broker with the policy attached, one for each product (Cyber and Property).

Our NextGen Broker Portal solution solves a lot of the time delays associated with historic manual systems and ensures that underwriting decisions are limited within certain rules. The market is changing and especially now with the coronavirus situation, digital Quote and Bind solutions will ensure the insurance industry is ahead of the curve, and, most importantly, able to write more business to boost profitability.

*In the photos above we use sample data for demonstration purposes

Conclusions

Research shows that when people work in a positive culture, performance on nearly every level improves – productivity, creativity, engagement, problem-solving abilities. It also turns out that optimism is the greatest predictor of entrepreneurial success.

In times of crisis, it is even more important to focus on the positive aspects which come with this global disturbance. These difficult times bring with them, in addition to a significant emotional impact, transformations and opportunities that the whole world could benefit from, in the long run.

For example, in an increasingly digitalized world, insurance companies already have access to all the technology they need to easily adapt to new customer behaviours, modelled both by the crisis generated by the pandemic but also by the adoption of digitalization in other areas related to a modern lifestyle. The implementation of this technology but also a cultural transformation is rather an act of will that can sometimes have to do with the very survival of the organization, going beyond the discomfort of adapting to a new state of facts.

At Encora whether you’re an Insurance Carrier, a Broker or a Managing General Agent, we have the data-driven services that will help your organisation accelerate growth.

| Explore our solutions and services

Claims Management Software · Data-Driven Underwriting Solutions · Data & Business Analytics Services · Contact |